EPF Rate variation introduced. Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia.

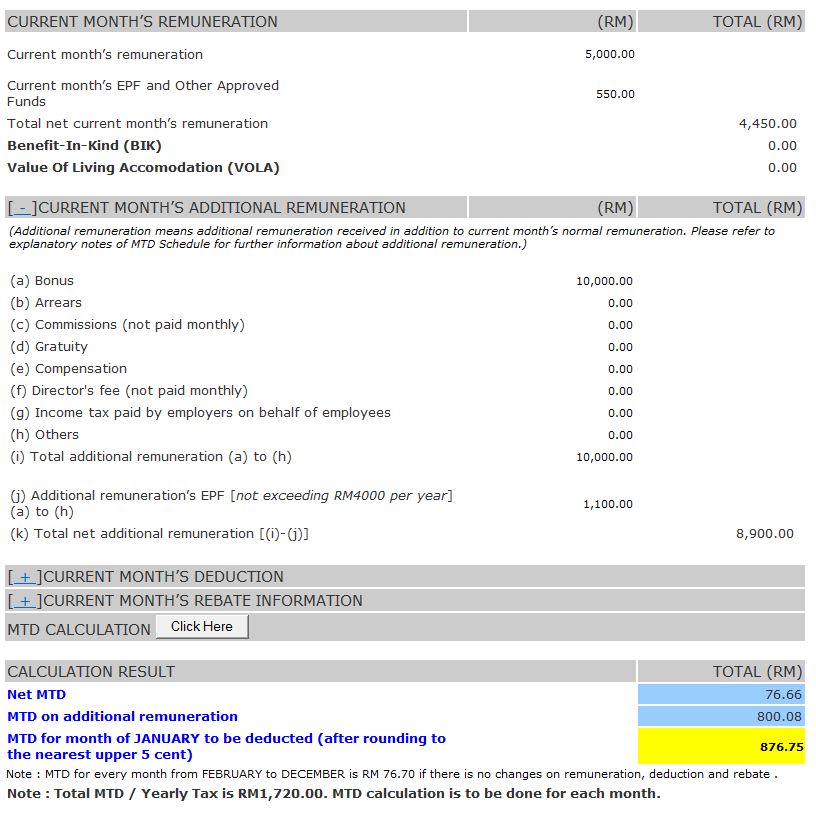

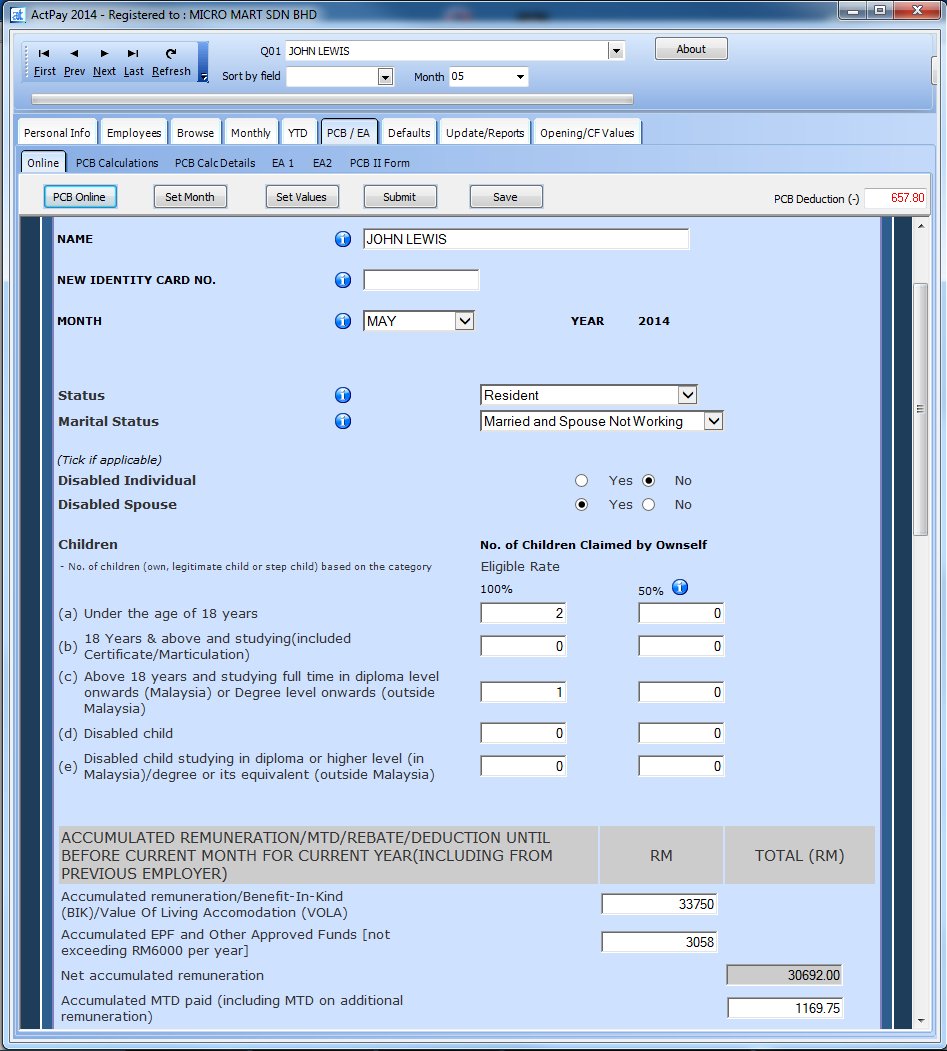

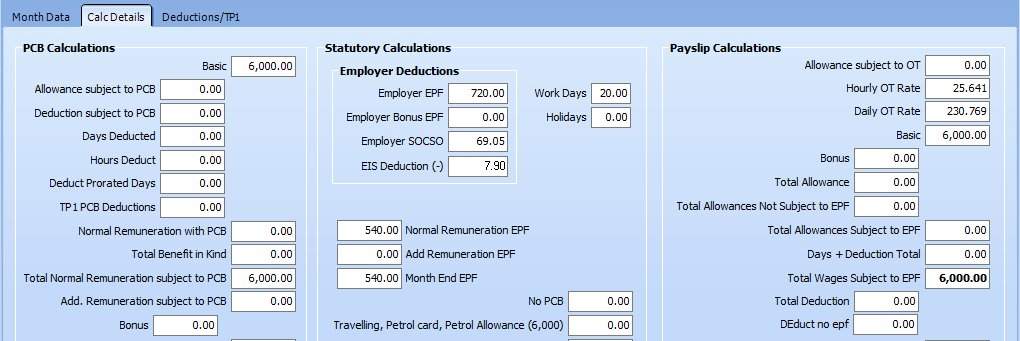

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

100 LHDN Compliance Malaysia Tax Calculator template specifically crafted based on LHDN procedures and Income Tax Act 1967.

. Malaysia Non-Residents Income Tax Tables in 2022. Most recomended using IE Browser. The most important concerns for a company that needs to comply with tax laws in Malaysia are the income tax for employees social security.

100 Accurate Calculations Guaranteed. And is based on the tax brackets of 2021 and 2022. Estimate Today With The TurboTax Free Calculator.

It is comply with LHDN tax calculation allowable expenses unallowable expenses expenses portion tax relief and others. Income Tax Calculator LHDN HRDF EPF SOCSO EIS and EPF. EPF Rate variation introduced.

The similarities would help the individual when filling up Form BE. Calculations RM Rate TaxRM A. Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia.

Flat rate on all taxable income. The system is thus based on the taxpayers ability to pay. User is required an internet banking account with the FPX associate.

This service enables tax payment through FPX gateway. You may have recognizeingly or unknowingly committed a tax crime and so they are trying to find judicial protection from legal guidance. PCB calculator Tax calculator EPF Payroll Sosco and EIS.

There are specific norms for payroll and taxation in Malaysia depending upon whether your company employs foreign nationals or local employees. These services can be used for all creditdebit cards VISA Mastercard and American Express issued in Malaysia. Jul 11 2022 the average salary for an accountant in malaysia is rm 50310.

Loan tenure your monthly net income credit score and other factors. Tax Payment via Credit Card through ByrHASIL portal will only be available from 1200 am until 1059 pm daily. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Income tax calculator lhdn how the tax regulations of California impact your organization. The Excel LHDN Calculator Form to calculate payable income tax is almost similar to Form BE. Income tax calculator lhdn how the tax regulations of California impact your organization.

Ad Try Our Free And Simple Tax Refund Calculator. Amendment of Estimated Tax Payable Form CP204A Companies cooperatives trust bodies and LLPs are allowed to amend the tax estimates payable by submitting e-CP204A. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

The estimated tax payable for the first year of assessment will be the basis for determining the estimated tax for the following year of assessment. Employer Employee Sub-Total - EPF Contribution. Average monthly net salary after tax salaries and financing.

It is mainly intended for residents of the US. You possess an property that is taxable and also you want assistance with the tax remedy associated to the estate. The nation hasnt seen such a high rate of unemployment since 1993.

Discover Helpful Information And Resources On Taxes From AARP. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Net Salary Calculator Malaysia This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit.

No More Guessing On Your Tax Refund. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. The 2022 tax values can be used for 1040-ES estimation planning ahead or.

Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. Introduced optional RM2000 special tax relief switch to comform to LHDNs standard. Resetting number of children to 0 upon changing from married to single status.

All Right Reserved e-Apps Unit Department of e-Services Application Inland Revenue Board of Malaysia. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. On the First 5000 Next 15000.

Update data for your city. On the First 5000. Resetting number of children to 0 upon changing from married to single status.

The individual would need to type in the numbers in the required sections highlighted in Orange and the Excel Form would automatically calculate the income tax payable. Income Tax Rates and Thresholds Annual Tax Rate. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Malaysia 2018 Mypf My

Cukai Pendapatan How To File Income Tax In Malaysia

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

How To Calculate Income Tax In Excel

Individual Income Tax In Malaysia For Expatriates

How To Do Pcb Calculator Through Payroll System Malaysia

Malaysian Tax Issues For Expats Activpayroll

The Complete Income Tax Guide 2022

How To Calculate Income Tax In Excel

Pcb Calculator 2021 Lhdn Approved Payroll Software

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

How To Calculate Income Tax In Excel

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

7 Tips To File Malaysian Income Tax For Beginners

Income Tax Malaysia 2019 Calculator Madalynngwf